Growth slows for Canadian farmland value amid declining field-crop prices ERIC ATKINS The Globe and Mail Published Monday, Apr. 10, 2017 12:01AM EDT Last updated Monday, Apr. 10, 2017 12:01AM EDT

The surge in the value of agric ultural real estate is cooling along with crop prices and farm revenues.

ultural real estate is cooling along with crop prices and farm revenues.

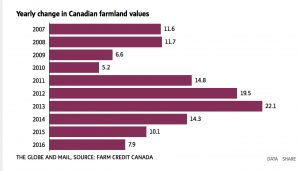

Average farmland values rose by 8 per cent in 2016, down from 10 per cent in 2015 and 14 per cent in 2014 according to Farm Credit Canada, the Crown corporation that is Canada’s biggest lender to farmers.

The biggest driver of the decline in growth is lower global prices for field crops, said J.P. Gervais, chief agricultural economist at FCC.

Prices for major Canadian crops including wheat, canola and corn have fallen from their peaks in 2013 and 2012 amid big global harvests and swelling stockpiles.

“We’ve had tremendous growth for the last 10 years, very significant growth. We’ve basically doubled crop receipts mostly across the country,” Mr. Gervais said on a conference call with reporters.

“But I think it would be a little unrealistic to think that the next 10 years will be like the last 10 years.”

Prince Edward Island saw the largest price increase in 2016 of 13.4 per cent, followed by Alberta at 9.5 per cent.

On a regional basis, British Columbia’s South Coast is Canada’s hottest market. The area, which includes the Fraser Valley, posted price increases of 17.7 per cent. This was driven by a large number of sales in the first part of the year as local farmers expanded and residential buyers sought rural properties, according to FCC’s annual report on farmland values, which does not report values in dollar amounts.

Aaron Goertzen, an agricultural economist with Bank of Montreal, said Canadian farmland and city real estate prices have soared for the same reason: low borrowing costs. He notes farm values continued to rise even after commodity prices started falling in 2012.

Canadian farmers, who export most of their grains, have avoided the revenue declines of their U.S. counterparts because the low Canadian dollar has cushioned them against lower crop prices. “That low loonie has propped up farm earnings so people are still willing to pay more for land,” Mr. Goertzen said by phone.

However, Mr. Goertzen warned interest rates look set to begin climbing, and the dollar will follow, nudged higher still by rising commodity prices. “I would expect to see farm prices slow further in the coming years so it’s not going to be, in my view, a bounce back to these really strong, unsustainable growth rates of 10 per cent that we saw for more than a decade,” Mr. Goertzen said. “I think the boom is certainly over, and the question now is what the adjustment to the new normal looks like.”

An acre on the average Canadian farm doubled in value between 2005 and 2015, to $2,700, including the buildings, according to Statistics Canada.

Ontario leads the list, at $10,000 an acre, followed by B.C. at $5,450 and Quebec at $5,100.

Restrictions on farmland purchases by foreign and institutional buyers vary by province, although B.C. and Ontario have no limits.

Mr. Gervais says he doubts foreign competition for agricultural real estate has had much of an impact on values, and says most sales are between producers. “At the end of the day, the supply of land remains quite limited,” he said.

Report Typo/Error

Follow Eric Atkins on Twitter: @ericatkins2