In a Forbes.com article published recently it compares land investment to gold investments.

Founder & CEO of AcreTrader, an online farmland investment platform.

Farmland and gold are two of the world’s oldest and most valuable asset classes, and they share many similar benefits that investors still find attractive today. Unfortunately, as those of us in the industry know, investing in farmland has been largely overlooked in recent decades.

However, both assets can provide investors with much-needed diversification, though each offers specific advantages. If you’re looking to invest in one of these alternatives, here are some important areas to consider when choosing between the two.

Returns And Volatility

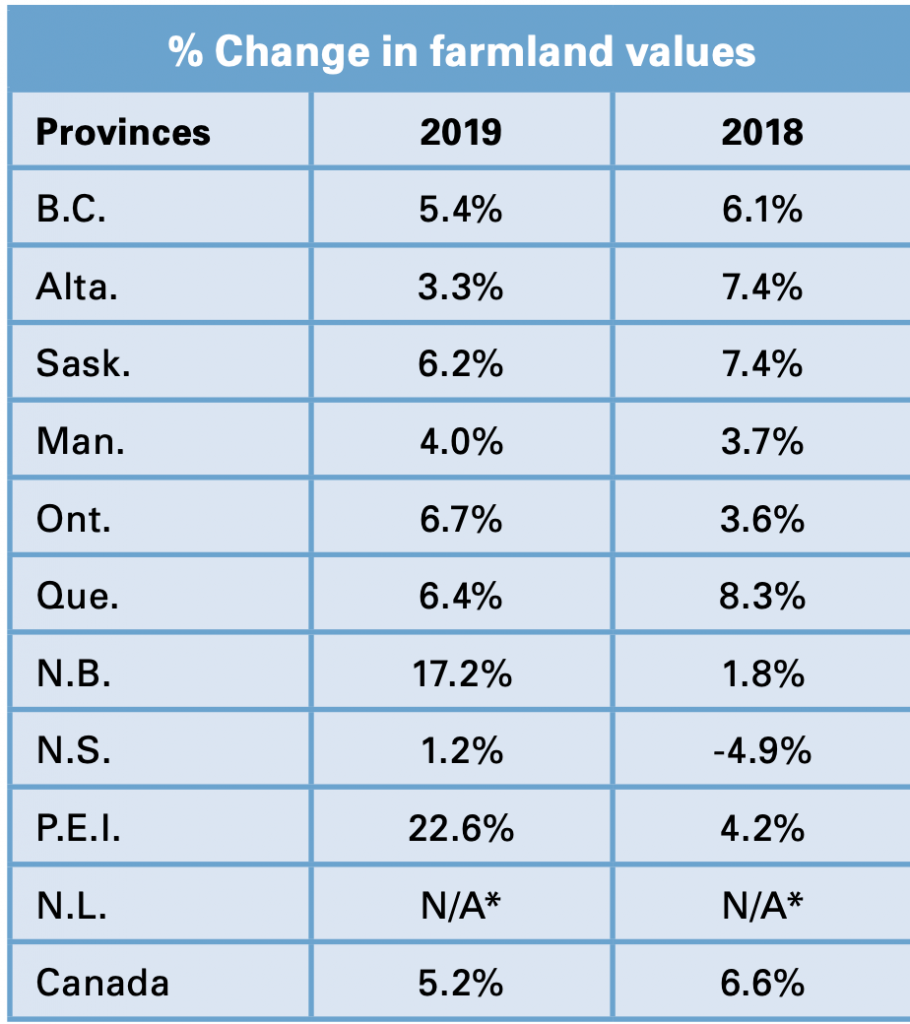

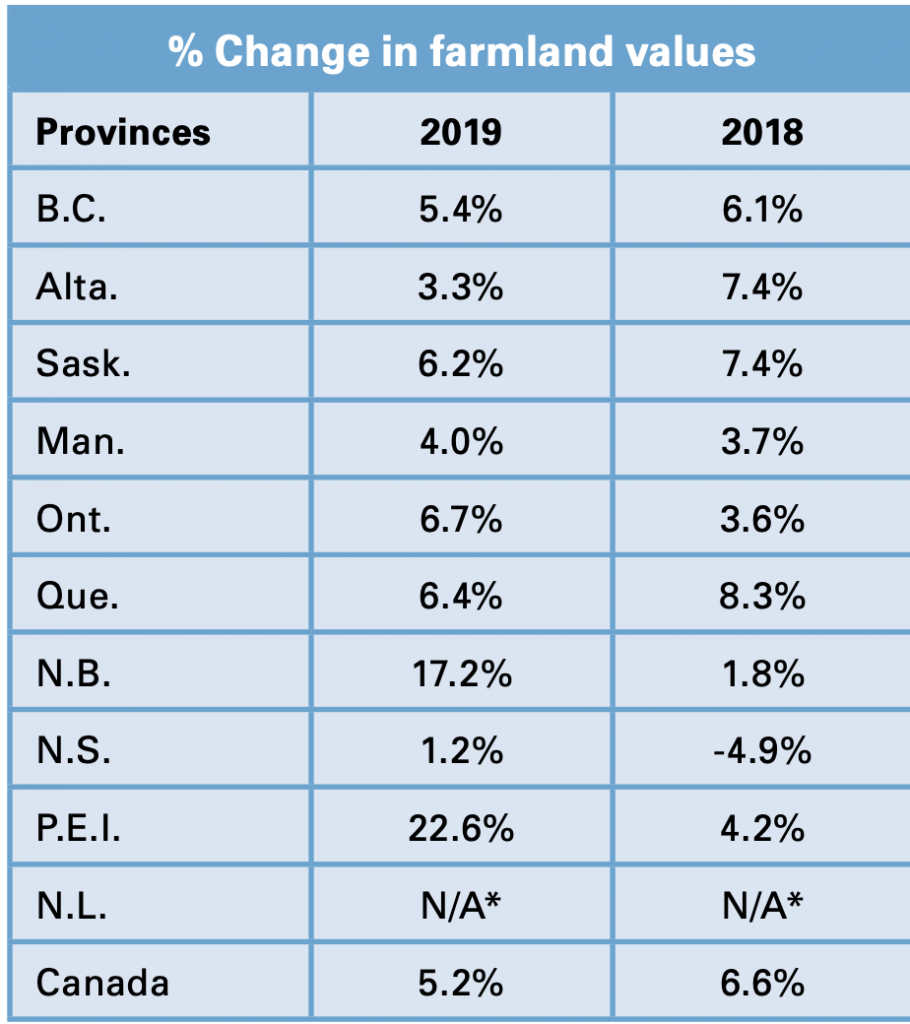

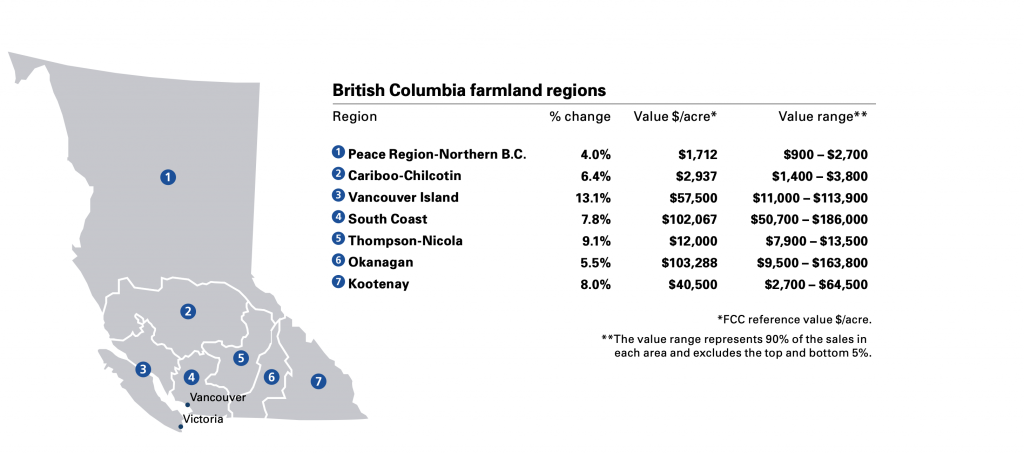

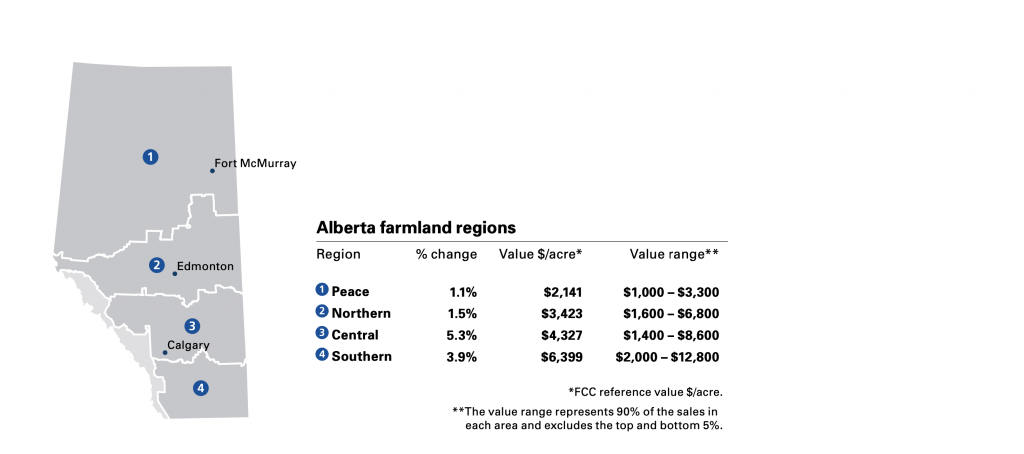

While gold has appreciated in value over time, it can have considerable volatility, which has resulted in losses as high as 32% in a single year. On the other hand,farmland has generated positive combined annual returns every year for the last 20-plus years. This is because investors in farmland typically make money from a) rent checks paid by tenant farmers every year and b) appreciation in land values.

As a result, farmland has produced greater returns with far less volatility than gold. Farmland prices have little or no correlation with the stock market, thus adding diversification to a standard investment portfolio.

Inflation Hedging

For many people, hedging against inflation has been one of the primary reasons for investing in gold. If you are not familiar with the term, an inflation hedge is an investment used as protection against the decreasing purchasing power of currency as the prices of goods rise.

For example, if the value of the U.S. dollar decreases, the dollar value of each ounce of gold typically rises as investors tend to flock toward more stable assets (this is often true during times of economic instability and recessions, as well).

While gold has proven as an effective hedge against inflation, farmland has historically tracked inflation slightly better.

Importantly, rising food prices often play a large role in inflation. Higher food commodity prices typically mean crops are worth more, thus the farmer is able to pay higher rent rates for land. Additionally, the supply of farmland has been decreasing while the demand for food continues to grow. For both of these reasons, farmland has offered consistent historical returns while proving a highly effective hedge against inflation.

Recurring Income

With farmland investments, you not only stand to gain from the appreciation of the land itself, but you can also earn additional income because it produces valuable commodities. This is a unique advantage of farmland investments compared to investments in gold.

Since gold is a non-producing hard asset, it doesn’t generate income throughout the holding period. You only stand to gain what someone else is willing to pay for it at selling time.

Entry Demands

Farmland is often viewed as “gold with yield,” but it can require greater industry knowledge to invest. To maximize returns from farmland investments, you must identify the right opportunities, ensure it is managed properly, and build relationships with great farmers and operators to farm it. While companies such as ours are working to democratize farmland investing via online platforms, gold is currently an easier and more common investment via gold-related equities, exchange-traded funds or even physical ownership.

Supply

While the supply of gold is by no means increasing at a rapid rate, it has continued to rise by just over 1% annually. According to the World Gold Council, worldwide gold mining annually adds about 2,500-3,000 tons to the above-ground stock of gold.

As the demand for gold increases, you will typically see that gold production increases, as well, due to the improved profitability of mining operations. As the supply of gold increases, the value of each ounce can be diluted.

Comparatively, farmland has been decreasing in supply at a rather alarming rate as more land continues to be developed for human use. Although there could be the potential for arable land expansion in some areas, the overall global and U.S. trend of decreasing farmland supply per capita is expected to continue.

Diversifying Your Portfolio

What is clear is that alternative assets, such as gold and farmland, provide another opportunity for investors to diversify their portfolios. Gold can be invested in with ease and helps with diversification, while farmland can provide extra income, favorable supply and demand dynamics, and the potential for greater risk-adjusted returns over time. While each has distinct advantages and disadvantages, they’re both worthy of consideration for investors looking for assets with inflation hedging and appreciation potential.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

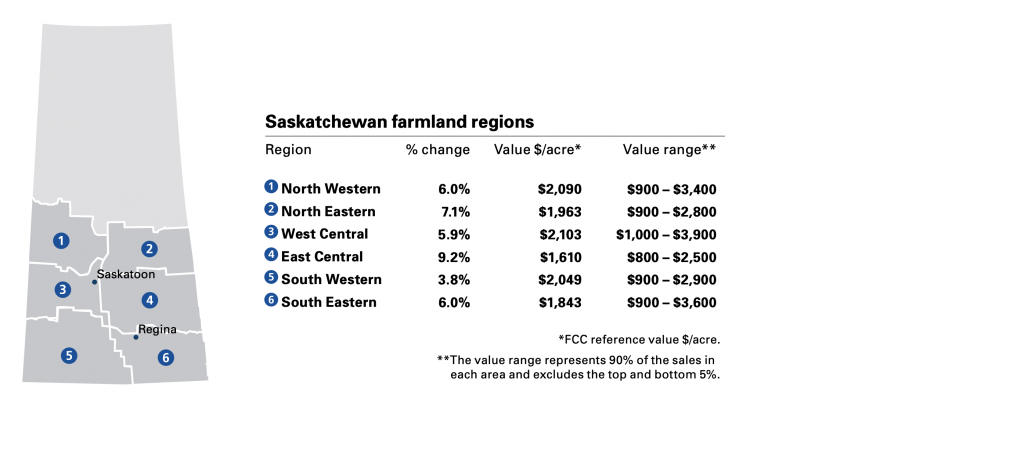

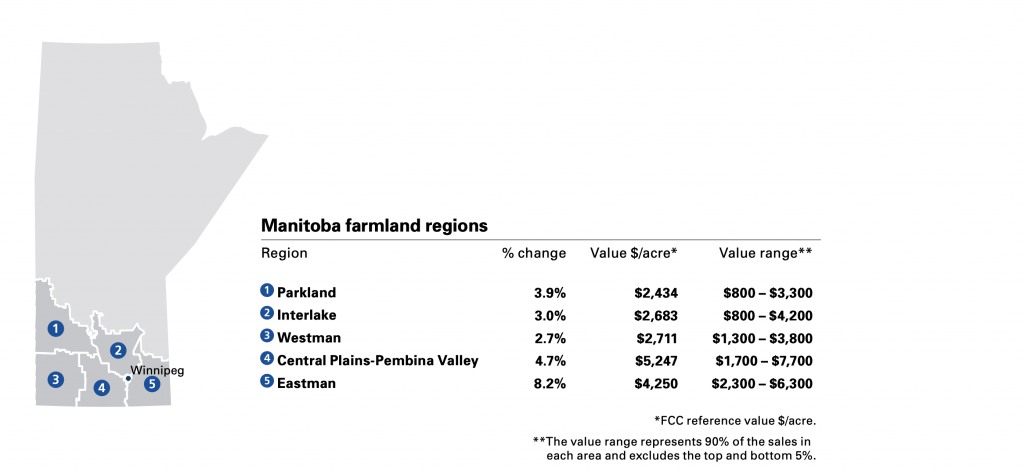

© (Pixabay) Farm fields are seen near Watrous, Sask.

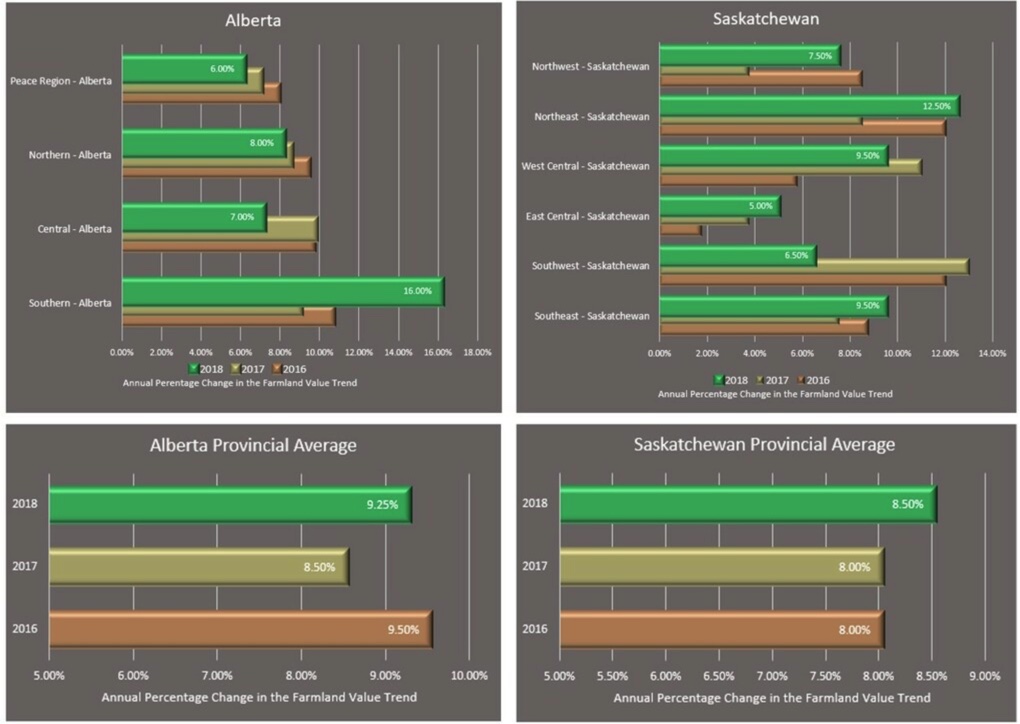

© (Pixabay) Farm fields are seen near Watrous, Sask. © (Created by Grant Alexander Wilson based on data from Statistics Canada and U.S. Department of Agric… Canadian and U.S. farmland appreciation (Canadian dollars), 1988 to 2018.

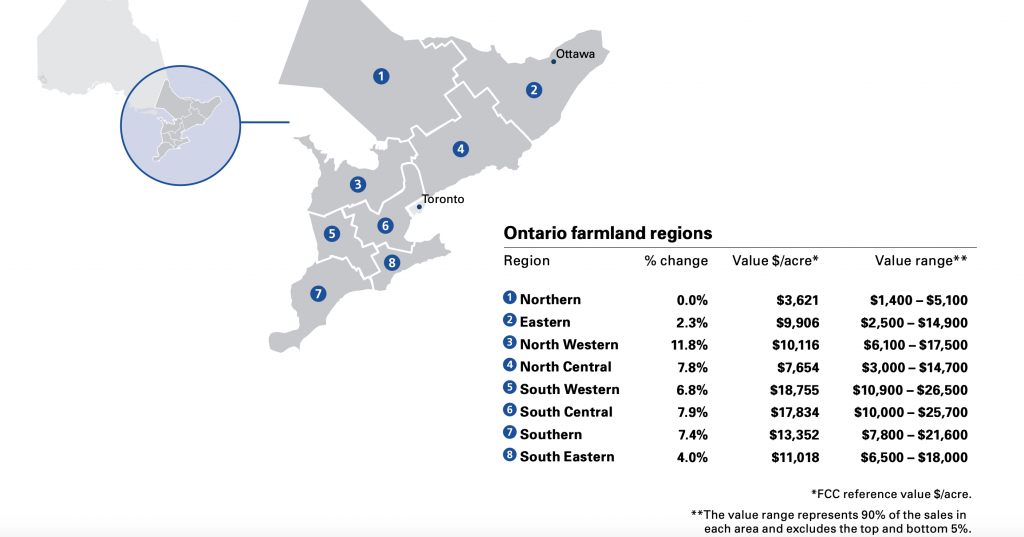

© (Created by Grant Alexander Wilson based on data from Statistics Canada and U.S. Department of Agric… Canadian and U.S. farmland appreciation (Canadian dollars), 1988 to 2018. © THE CANADIAN PRESS/Adrian Wyld A farm tractor is silhouetted against a setting sun near Mossbank, Sask.

© THE CANADIAN PRESS/Adrian Wyld A farm tractor is silhouetted against a setting sun near Mossbank, Sask. © (Created by Grant Alexander Wilson based on Farm Credit Canada and Yahoo Finance) TSX vs. Canadian farmland appreciation 2009-19.

© (Created by Grant Alexander Wilson based on Farm Credit Canada and Yahoo Finance) TSX vs. Canadian farmland appreciation 2009-19. © (Joshua Reddekopp/Unsplash) There are few storms on the horizon for Canadian farmland in terms of future investment yields.

© (Joshua Reddekopp/Unsplash) There are few storms on the horizon for Canadian farmland in terms of future investment yields.