Canada, Australia and the U.S.: Three countries. Three agriculture industries. Each is a global ag powerhouse, exporting some of the world’s largest ag commodity values, and they compete directly with each other. Despite their similarities, together they show how the same economic drivers can produce entirely different patterns in farmland values’ growth rates.

Here’s how.

Patterns in growth of farmland values differ

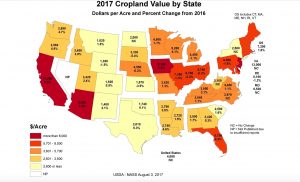

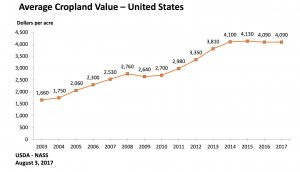

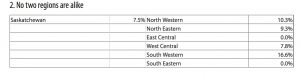

All three markets saw their farmland values increase at least once over the last three years, but at rates of growth, and in patterns, that differed dramatically. Both Australia and Canada saw only growth over the last three years, while U.S. values, which fell for five consecutive quarters, now appear to have halted their slide.

Different outcomes – but the same drivers behind farmland values

We’ve often repeated that farm income and interest rates are the two most important drivers of farmland values. Given that, it’s not hard to see why values have increased in all three countries. Each Central Bank’s key interest rate has been trending down for several years. Despite recent upward pressures on borrowing costs in the U.S. and Canada, they remain near historical lows. A tight inventory of available farmland has also resulted in strong purchase bids and higher average prices.

But farm income matters most.

Canadian net cash income (NCI) reached a record-high CA$15.7 billion in 2016. It’s grown 23.7% since 2014. The net value of agricultural production in Australia also peaked during the 2015-16 marketing year, having increased by a double-digit rate in the last 3 years.

The U.S. was different. Net cash income declined by a whopping one-third, falling from US$135.6 to US$91.9 billion, between 2013 and 2016.

The stronger USD is one of the biggest culprits in explaining the divergence among the three markets. In fact, the year-to-date average value of the loonie relative to the USD is 15% below its 5-year average. The Aussie dollar has depreciated 14% vs the USD at the same time.

Canadian agriculture is healthy right now, in part because of the recently devalued loonie. We expect it to average US$0.75 for the remainder of the year which, if correct, will support further NCI growth. Now, while the economics are good, is the best time to go over your marketing plans and build contingencies for the days when the market will trend in a different direction.